Maybank/Maybank Islamic myimpact Credit Card

A new era of sustainable spending.

Annual Income: RM36,000

Annual Fee: Lifetime fee waiver

Features:

- Carbon Footprint Tracker

- Offset Your Carbon

- Eco-friendly Card Material

- No Compounding Interest / Management Fee

- No Late Payment Charges

- No Annual Fee

- 1% Cashback on ESG-friendly Merchants

- 0.5% Cashback on Contactless Payments

- 1 x TreatsPoints for Every RM 1 Retail Spending

Maybank/Maybank Islamic myimpact Credit Card

Key Benefits:

Maybank/Maybank Islamic myimpact Credit Card

Available:

Promotion:

Maybank/Maybank Islamic myimpact Credit Card

Available:

Promotion:

Maybank/Maybank Islamic myimpact Credit Card

Available:

Promotion:

Promotions

What is the Maybank/Maybank Islamic myimpact Credit Card?

The Maybank/Maybank Islamic myimpact Credit Card is all about rewarding you for being sustainable! Enjoy these benefits as you make choices which are good for you today, and even better for the future.

Card Rewards:

- Get rewarded with a RM50 welcome bonus cashback when you spend a minimum of RM1,500 within 90 days from card approval, including 3 transactions in Environment, Social & Governance (‘ESG’)-friendly categories.

- 1% cashback when spending at ESG-friendly categories, capped at RM35 per month.

- 0.5% cashback on other retail spending using contactless payment, Apple Pay and Samsung Pay, capped at 35% per month.

- 1x TreatsPoints for every RM1 spending.

Track & Offset your carbon footprint:

- Gain insights about your environmental impact across your lifestyle with the Carbon Footprint Tracker, an exclusive feature for this credit card.

- You may choose to offset your carbon footprint by contributing to reforestation initiatives through a Carbon Offset feature via the Maybank MAE app & Maybank2U website.

Fee & Charges:

- No compounding interest / management fee

- No late payment charges

- No annual fee

Terms and conditions apply. See below for more information.

Why is it important to know my carbon footprint?

CO2 makes up the vast majority of greenhouse gas emissions which have been rising through the decades, leading to global warming and contributing to climate change. The carbon footprint estimates are useful to help you understand your personal impact on the environment.

As more transactions are analysed, you will be able to assess your historical carbon footprint, and gain insights about your environmental impact across your lifestyle. More importantly, knowing your personal environmental impact helps you understand and plan to offset your carbon.

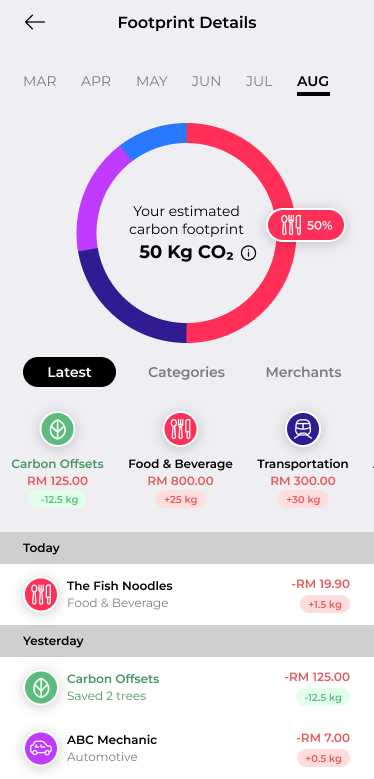

What is the Carbon Footprint Tracker?

The Carbon Footprint Tracker is an exclusive feature for this credit card available to you on the Maybank MAE app and Maybank2U website. It allows you to calculate your CO2 emissions in kilograms, so you have a view of your estimated carbon emissions.

Click here to find out more on how your card transactions for your carbon footprint is derived.

MAE App:

Maybank2U website:

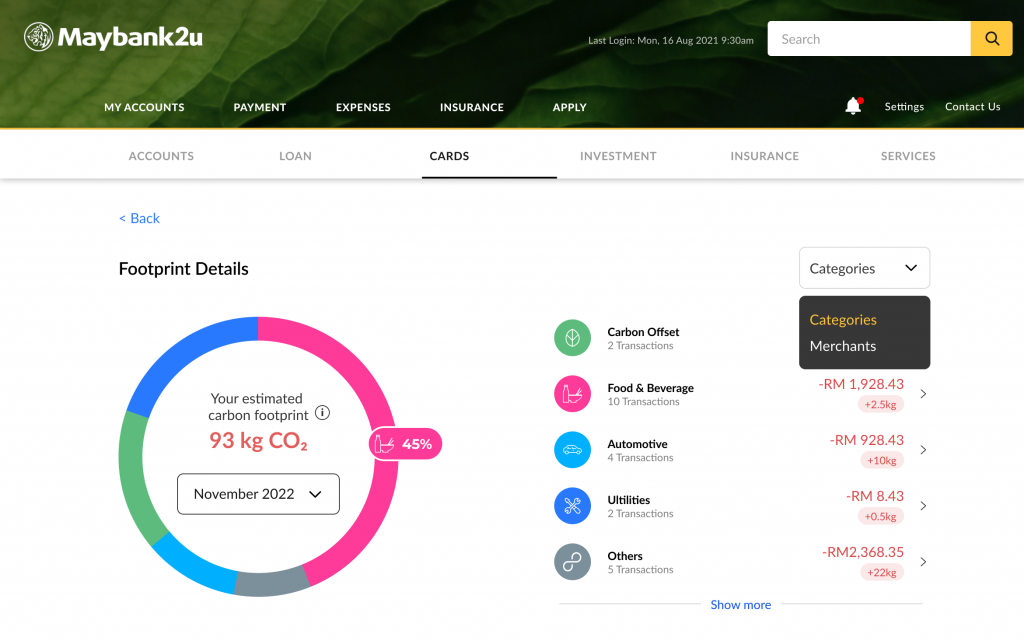

How can I offset my carbon footprint?

I love that I can view my carbon footprint! Now what?

You may choose to offset your carbon footprint through a Carbon Offset feature via the Maybank MAE app and Maybank2U website. You can do so by making a financial contribution, which goes towards regional reforestation initiatives, whose main goals are to neutralise the effects of unavoidable carbon emissions.

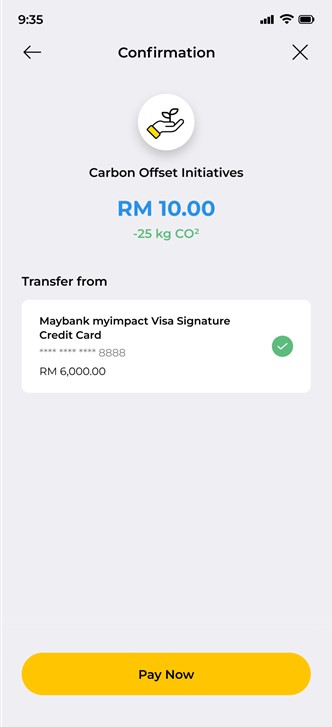

Step 1: Click on the “Carbon Offset” icon on your dashboard. Select the contribution amount you would like to offset your carbon footprint:

Step 2: Select your Maybank/Maybank Islamic myimpact Credit Card to contribute to the Carbon Offset Programme, where you will also be able to see how much CO2 you will be offsetting:

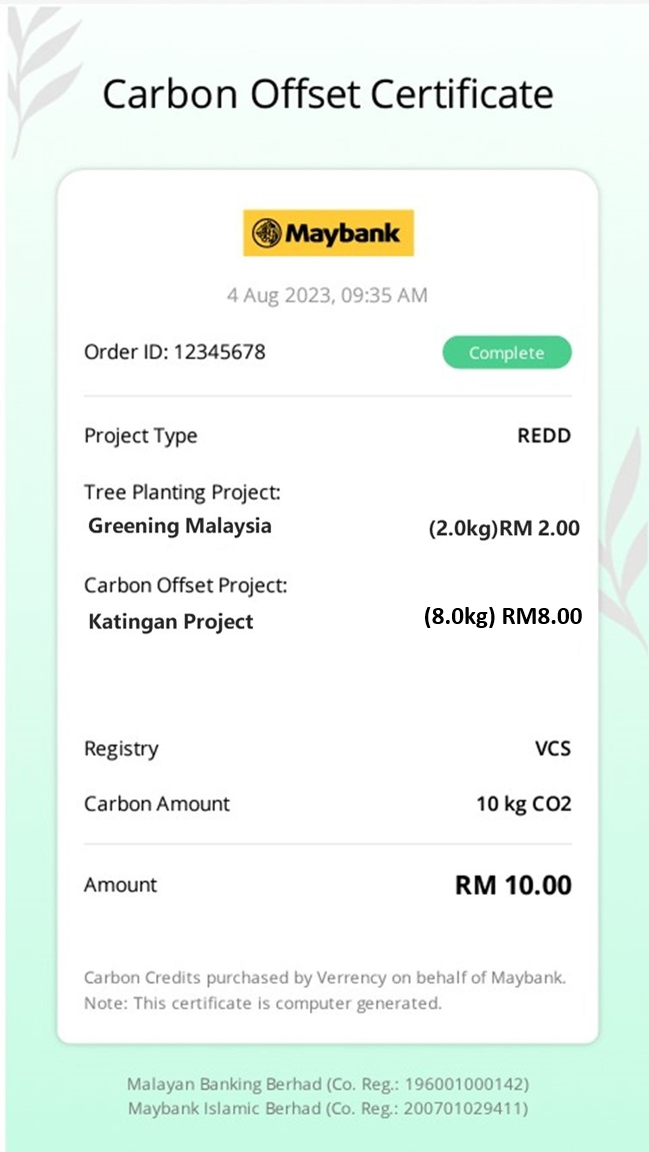

Step 3: Once you have confirmed your transaction, your purchased carbon credits will be channeled to the regional reforestation initiatives on your behalf. You will receive a Carbon Offset Certification for your contribution:

How will my contribution help?

Your financial contribution will be distributed to the regional reforestation initiatives, which consist of one Reforestation Donation Programme and one Reducing Emissions from Deforestation and Forest Degradation (REDD+) projects in Southeast Asia. Each one promotes reforestation efforts, improvement of livelihoods, reduction of poverty in local communities, and implementation of flora and fauna conservation. You will be contributing to these organizations:

- The Greening Malaysia Programme

- Katingan Conservation Project, Indonesia

Click here to learn more.

Note: Should any of the identified programme/project be oversubscribed, the outstanding amount will be redistributed over the next available project(s) with prior notice made to cardmembers.

To find content please access the link below and go to How will my contribution help? category:

https://mytreats.maybank.com/cardpromotions/malaysia/2023/08/31/maybank-maybank-islamic-myimpact-credit-card/?var=fs

Fees & Charges

- No Compounding Interest/Management Fee

The interest/management fee charged to your Maybank/Maybank Islamic myimpact Credit Card (wherever applicable) is calculated using the principal amount only and does not include the accumulated interest/management fee of the previous period(s).

- No Late Payment Charges

1% of the unpaid outstanding balance as per statement or minimum of RM10 is not applicable to this Maybank/Maybank Islamic myimpact Credit Card

- No Annual Fee

Card Rewards

Cashback

- 1% cashback when spending at Environment, Social & Governance (‘ESG’)-friendly categories with these sample merchants*, capped at RM35 cashback per month:

Commuter Rail and Bus Transportation |

Ride-Hailing & Car Rental Services |

EV Charging and Solar Energy Services |

Education Tenby Schools, Asia Pacific Smart School, KLASS o.p.s, Nobel International School, Beaconhouse, Sri KDU, University Teknologi MARA, International Medical University, Open University Malaysia, Universiti Teknologi Malaysia, Taylor’s University, HELP University |

Sporting Goods/Membership and Pharmaceutical Items Celebrity Fitness, ClassPass, Fitness First, Anytime Fitness, CHi Fitness, Watsons, Guardian, CARiNG Pharmacy, BIG, AA Pharmacy, Health Lane Family Pharmacy, AEON Wellness, Sports Direct, Original Classic, Royal Sporting House, Stadium, Decathlon, Al-ikhsan, JD Sports, Fitness Concept, Sun Paradise, Rodalink, Specialized, Rapha, Cyclist Wardrobe, KSH Bicycles, The Bike Artisans |

Used Merchandise Stores and Repair Services Mister Minit, MyBagSpa, 99 Leather Kraft, iPRO, Premier Luggage & Bag, Cash Converters, Jalan Jalan Japan |

*This list is by no means exhaustive but shows the sample merchants that are eligible for the 1% cashback.

• 0.5% cashback on other retail spending* using contactless payment, Apple Pay and Samsung Pay, capped at RM35 cashback per month.

*No cashback will be awarded when spending at these merchant categories: Petrol, Airlines, Government Bodies / JomPAY, E-wallet Reloads, Cash Advance, or Utilities.

TreatsPoints

- 1x TreatsPoints for every RM1 spending*

Note: TreatsPoints validity: 3 years

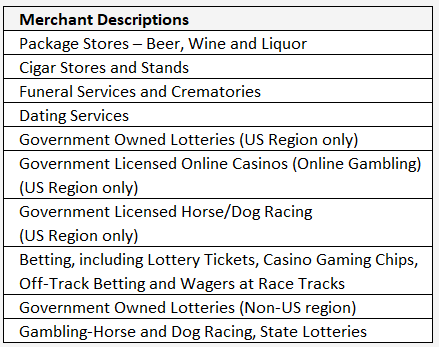

Non-Shariah Compliant Merchant Categories

(Applicable to Maybank Islamic myimpact Ikhwan Mastercard Platinum Credit Card-i only)

Maybank Islamic myimpact Ikhwan Mastercard Platinum Credit Card-i cannot be used at non-Shariah Compliant Merchant Categories, which include, but are not limited to the following:

Additionally, any other non-Shariah compliant merchants will be communicated by Maybank periodically.

Mastercard Priceless Experience

(Applicable to Maybank Islamic myimpact Ikhwan Mastercard Platinum Credit Card-i only)

Discover a world of priceless benefits & offers curated for Mastercard cardmembers – spanning from shopping, travel, culinary, sports, entertainment and arts.

Below are some of the privileges that you can enjoy:

- E-Commerce Protection

- Mastercard Global Services

- Mastercard Concierge

Visit www.priceless.com for more info.

Visa Signature Privileges

(Applicable to Maybank myimpact Visa Signature Credit Card only)

Maybank Visa Signature Customer Service

- Service available 24 hours a day, 7 days a week.

- Call: +603 7949 0626

- Email to: MalaysiaSignature@concierge-asia.visa.com

Visa Airport Speed Pass

- Fast track immigration at over 280 international airports

- Visit speedpass.yqnowgroup.com for more information on participating airports

Visa Signature Concierge Service

- 24 hours a day, 7 days a week concierge service by Visa Signature. Services are also available via Concierge online.

- Cost of any goods or services purchased billed directly to cardmember’s Maybank myimpact Visa Signature Credit Card.

- Visa Signature Concierge services include:

- Travel information and assistance

- Country and major city information

- Gift and specialty services

- Business services

- Entertainment services

- WhatsApp chat: +60 1800 805 572 or https://wa.me/601800805572

- Website: www.concierge-asia.visa.com

- Hotline: 1800 803 006

IDD: 1800 805 572 - Email: MalaysiaSignature@concierge-asia.visa.com

- Mobile App: Available for both iOS and Android devices

For more information on Concierge online please visit the Visa Signature App website www.visasignature-asia.com

Travel Insurance Coverage

- Up to RM2 million in Travel Insurance Coverage when the cardmember charges their travel ticket in FULL to their Maybank myimpact Visa Signature Credit Card.

- Travel coverage:

- Travel Personal Accident Insurance – up to RM1 million

- Missed Flight Connection (after 12 hours) – RM1,000

- Luggage Delay (after 12 hours) – RM1,000

- Lost Luggage (after 48 hours) – RM3,000

In the event of claims for luggage delay or loss, your purchase of essential clothing and requisites must be charged to your Maybank myimpact Visa Signature Credit Card. Cash or usage of other cards will result in non-payment of claims.

How to apply?

Required Documents

Please include the following with your application form:

- Copy of NRIC (both sides) or Passport, including that of supplementary applicant’s

- Latest BE form with official tax receipt

- Latest 3 months’ salary slips

- Latest 6 months’ savings account activity/current account statement

If you are self-employed:

- Copies of Business Registration

- Latest 6 months’ Bank Statements

If you are an expatriate:

- Letter from employer confirming duration of employment contract in Malaysia

Other Information

- Click here for Maybank Credit Card Agreement

- Click here for Maybank myimpact Visa Signature Credit Card Product Disclosure Sheet

- Click here for Maybank myimpact Visa Signature Credit Card Cash Back Terms & Conditions

- Click here for Maybank myimpact Visa Signature Credit Card Certificate of Insurance

- Click here for Maybank Islamic Credit Card Agreement

- Click here for Maybank Islamic myimpact Ikhwan Mastercard Platinum Credit Card-i Product Disclosure Sheet

- Click here for Maybank Islamic myimpact Ikhwan Mastercard Platinum Credit Card-i Cash Back Terms & Conditions

- Click here for Maybank myimpact Credit Card Frequently Asked Questions

- Click here for Welcome Bonus Campaign Terms and Conditions